Blog

Monetization of the AI Internet

by Danielle Lay, Mason Murray and Alexa GrabelleJan 15, 2026

The Internet, Until Now

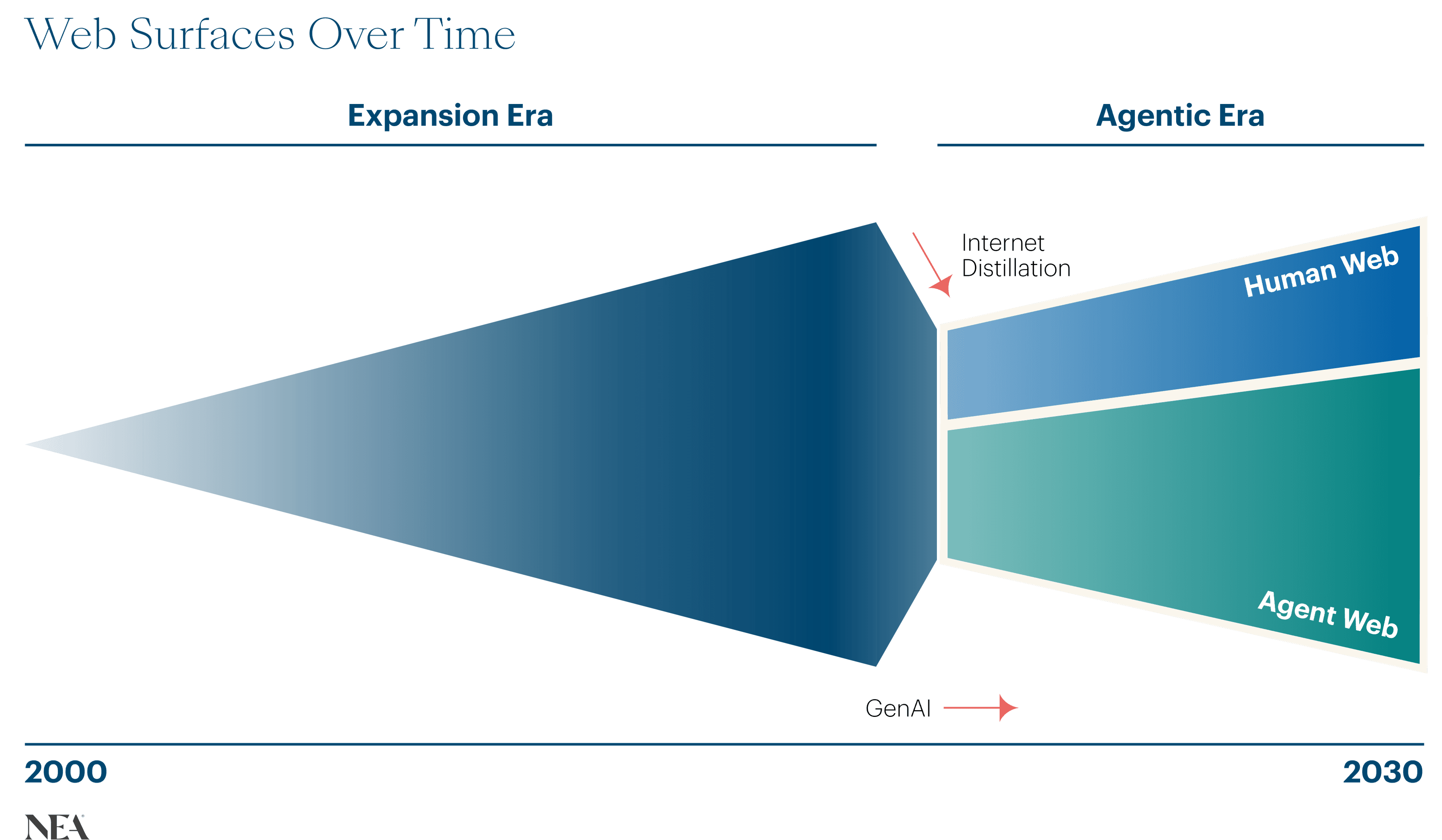

For nearly twenty-five years, the internet moved in one direction: outward. Each year unleashed a surge of new websites, apps, creators, and marketplaces – all battling for a sliver of our shrinking attention span. Distribution sprawled, inventory ballooned, and the dominant logic of the web emerged: if you build something, someone will eventually find it. Advertising thrived on this abundance.

That era is coming to a close, and a new version of the internet is taking over. The agentic internet is mediated not by human navigation but by sophisticated AI systems that compress the sprawl. Instead of sending people to billions of webpages, agents resolve intent and narrow the scope at the point of query.

To predict how the economics of the internet will evolve from here, we need to understand the shift from Expansion to Distillation. Then, we’ll explore new building blocks for monetizing the agentic internet.

The Expansion Era (2000s-2023)

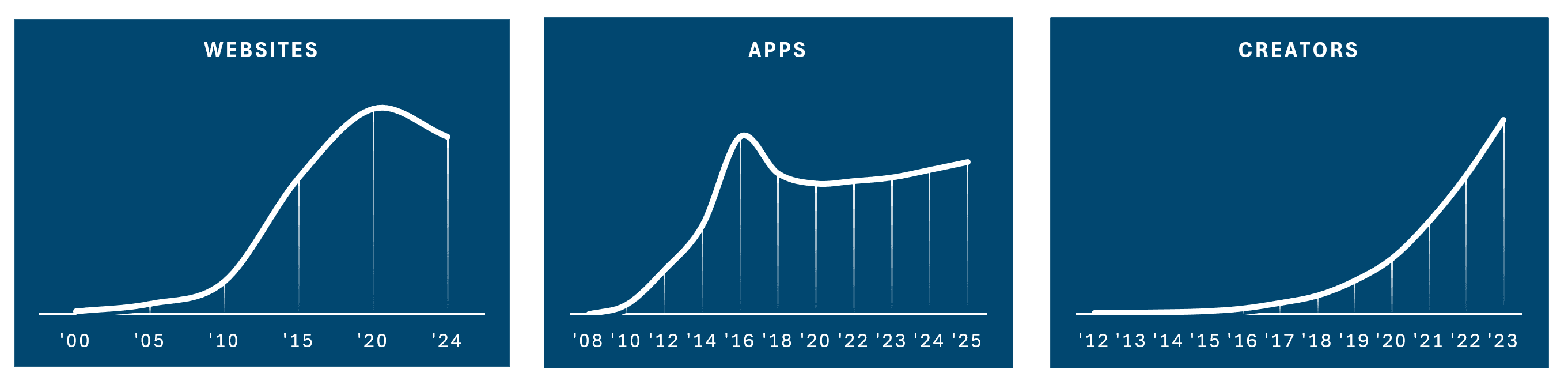

The internet was defined by proliferation – every company, creator, and category spawned its own digital surface

Websites exploded: 17M in 2000 to 1B+ by 2024

Apps multiplied: Apple App Store went from 500 apps in 2008 to 2M+ apps in 2025

Content atomized: Every niche had its own blog, newsletter, YouTube channel, TikTok, podcast — sparking the rise of the creator economy

Marketplaces fragmented: Horizontal giants emerged (Amazon, eBay, Etsy) and then splintered into vertical-specific platforms (Uber, Airbnb, StockX, Reverb, Poshmark, Faire)

The underlying logic of this era was clear: more surface area + more content = more discoverability = more traffic = more value. Search Engine Optimization (SEO), social algorithms, and app stores rewarded creation. Distribution was abundant and fragmented at the same time, and if you could capture even a sliver of attention within your niche, you could monetize it.

The Distillation Era (2023→)

The agentic internet inverts the logic of digital abundance as we know it

With generative search, you no longer visit dozens of websites to research a purchase. Agents compress the web on your behalf to synthesize content, provide informed (and often personalized) recommendations, and eventually, take action for you.

In this transition, the long tail of the internet is losing its economic utility. Not because the information isn't valuable, but because agents resolve intent in place, without needing to redirect users to the open web where their attention is monetized through ads.

While agent-initiated traffic compounds, the human-facing web enters a chapter of distillation. What will remain important are surfaces where agents can't fully replace the human experience. In fact, much of the internet we rely on daily falls into three categories that resist agentic compression:

I. High-Trust Surfaces

Authoritative and hard to replicate. These sources persist because credibility matters. Trust is a formidable moat, and agents can't fabricate authority when the cost of error is high.

Primary sources: Government sites, academic institutions, original research

Marketplaces with high-trust transactions: Amazon, Uber, Airbnb (all of which offer verified inventory, payment rails, and dispute resolution)

Premium publishers: NYT, Bloomberg, specialized trade publications

Regulated domains: Healthcare, finance, legal (where agents require human oversight)

II. High-Context Surfaces

Where identity creates unique value. Generic agents can't replicate your social graph or personal history.

Walled garden social platforms: Instagram, TikTok, Twitter/X (your graph is non-portable)

Logged-in ecosystems: Netflix, Spotify, Amazon (deep stores of user taste, identity, and transaction history)

Communication layers: Email (including newsletters), messaging

III. Entertainment or Opinion Surfaces

Surfaces where the experience itself is the product.

Media: Gaming, streaming, live sports

Discovery-as-entertainment: Creators, TikTok, Instagram Reels, YouTube Shorts

Non-utilitarian commerce: Fashion, furniture, art (where "seeing it" matters)

Monetizing the Human-Facing Internet

AI Catalyzing the Shift: From Optimization of Generic Volume to Hyper-Specific Targeting

Although human attention is consolidating into high-trust open web and AI-native applications, ads will remain crucial for monetization.

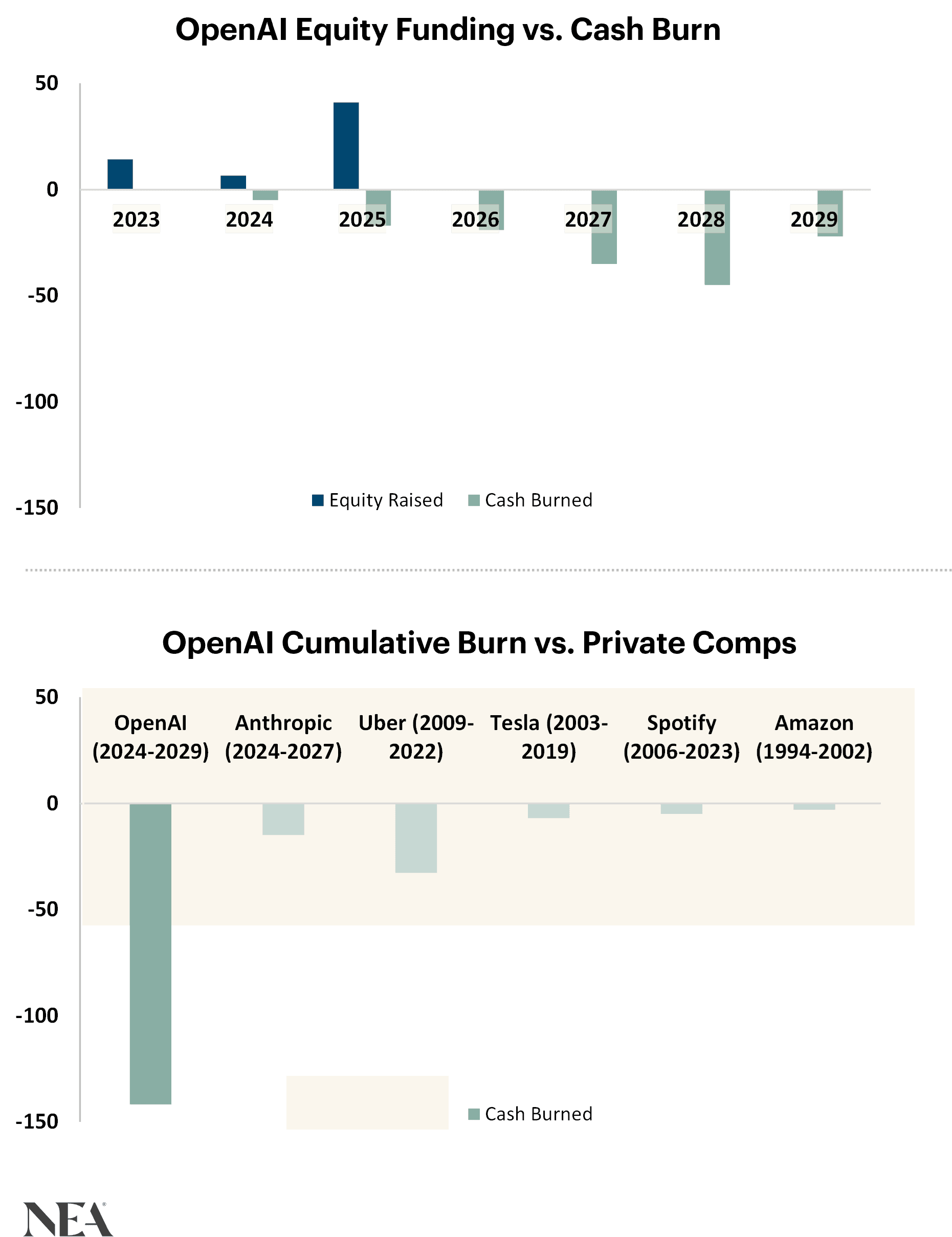

Exploration: Can OpenAI survive without ads?

Unlike prior consumer internet platforms, OpenAI’s marginal costs do not asymptotically approach zero. Training, inference, and distribution scale together, creating a structural gap that subscription revenue alone may struggle to close. Even optimistic assumptions around paid conversion and pricing leave a sizable funding gap—raising the question of whether a second monetization layer, like advertising, is eventually required. Past generational companies burned heavily to build distribution and demand gen; OpenAI is burning to build capability itself. That distinction matters for how (and how quickly) the business will need to diversify revenue. (4)

AI is enabling a paradigm shift from low-signal visibility metrics to high-signal targeting. The advertising gold standard — showing the right creative to the right person at the right time and place — has been virtually impossible until now. Performance marketers have relied on lowest-common-denominator strategies: ad creative optimized for the median user, priced on visibility (CPM models).

Just as CPUs enabled real-time bidding in the 2000s, GPUs and advancements in the clock-speed of generative models are accelerating the timeline to real-time creative personalization.

Two key unlocks will make this possible:

Speed: The 2022 ChatGPT moment and proliferation of LLMs, image, video, and audio models collapsed components of creative production from weeks to minutes to seconds

Economics: Inference costs compressed 280-fold between November 2022 and October 2024, making real-time generation economically viable in a tightly optimized, arbitrage-seeking market like advertising

Early adopters like OpenAds are validating this thesis with measurable results. As one of the first AI-native DSPs, OpenAds generates unique, hyper-contextual creative for every impression using LLMs — creating one-of-a-kind ads rather than selecting from preset variants. (Read more via founder Steven Liss's Thinking Fast and Cheap.)

This shift is increasingly critical as attention-based models face ROAS pressure from rising non-human traffic and the weakening correlation between impressions and user actions.

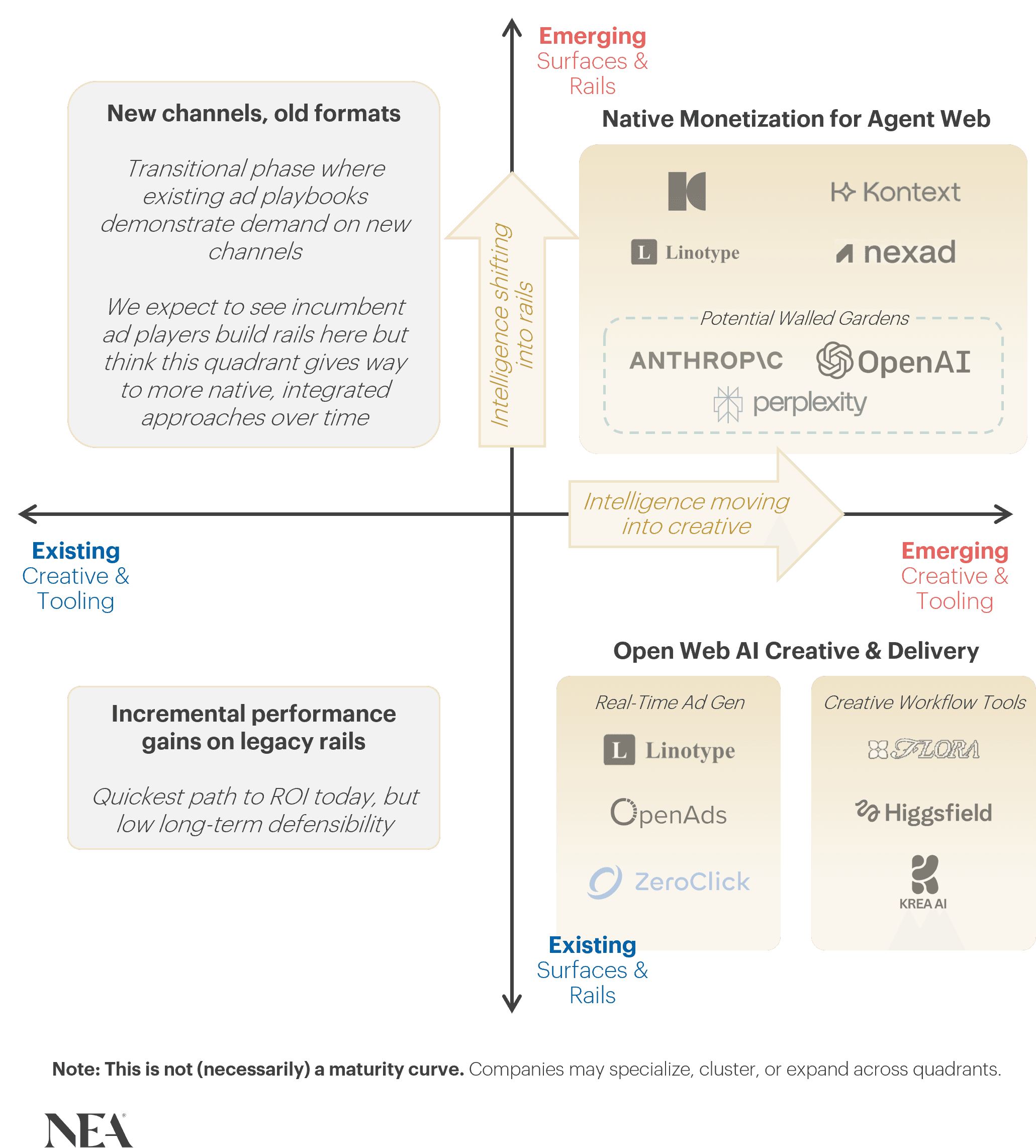

We view the human-facing internet's evolution across two vectors: surfaces & rails, and creative formats & tooling. Most of all, we’re excited about innovators leveraging generative AI breakthroughs to revolutionize ad engagement across both AI-native applications and existing open web infrastructure.

New Creative Tooling: Turbo-Charging Performance Marketing with Real-Time Generation & Insight

Hyper-personalization at scale is supported by two layers of innovation: (1) creative generation and (2) campaign insights.

Vertical creative advertising platforms like Mark OS and horizontal creative middleware platforms like Flora, Higgsfield, and Krea enable customers to economically generate (and iterate upon) high-fidelity, brand-compliant creative in minutes, greatly compressing cycle times and costs. Today, this enables the creation of much more granular advertising campaigns to test and distribute at scale. In the future, we believe these creative design cycles will converge to the point of intent, where brands, upon winning an ad spot through a DSP/ad network, will generate creative that is served in real-time based on user context fed through the network, resulting in enriched UX that is more likely to lead to strong ROI for participating brands.

Alongside creative generation, AI has also enabled rapid, continuous scraping and analysis of the web — where brands previously used heuristic media mix modeling (MMM) to optimize ad spend, they can now use real-time data to pinpoint trends, spot mispriced ad units, and deploy creative where it’s most likely to convert. Polynomic is automating this process end-to-end for brands. The core of Polynomic’s platform is identifying profitable ad opportunities in real time across 200+ media buying platforms — analyzing auction dynamics, regional trends/exogenous events impacting demand, and consumer trends to find arbitrage opportunities, build relevant campaigns in real-time, and automatically deploy them. Continuous scraping promotes a self-improving cycle where attribution data from each subsequent campaign feeds into the model to produce future high-efficacy campaigns, improving targeting and driving ROAS.

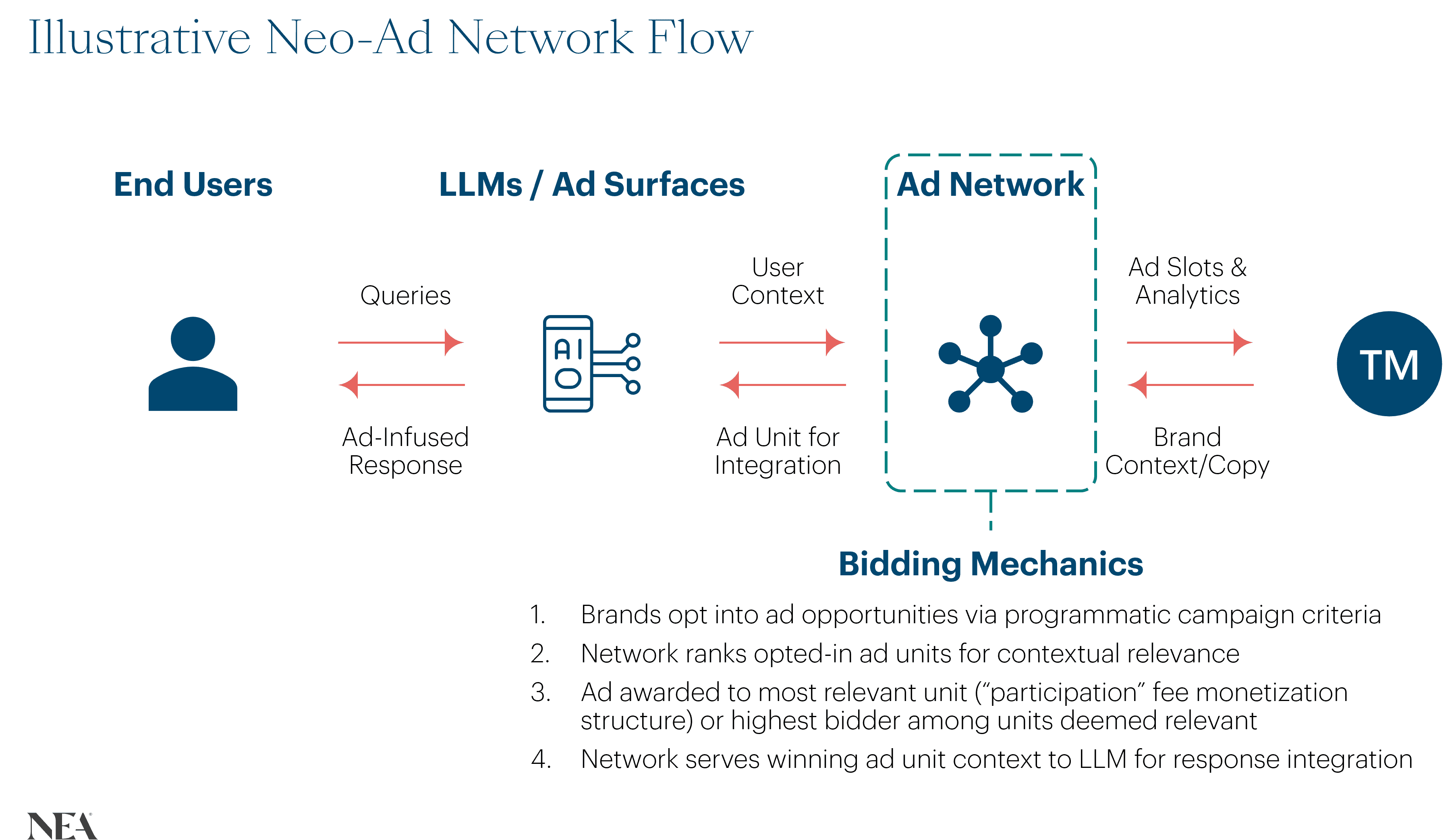

New Rails and Surfaces: Neo-Ad Networks Purpose-Built for AI Applications

We’re witnessing the emergence of a new advertising primitive: real-time ad injections inside LLM responses, designed for unprecedented incentive alignment among users, platforms, and brands.

We believe this approach has the ability to outperform traditional programmatic networks by:

Delivering contextually relevant ads in less obtrusive formats

Improving brand ROAS through enriched LLM context, granular user targeting, and real-time ad personalization

Unlocking high average selling price (ASP) ad economics as a scalable revenue stream for AI applications

As model memory matures, richer user context activates a positive flywheel: precise brand targeting improves UX and retention, generates data for better targeting, and boosts advertiser performance and publisher monetization.

Foundation model businesses face structurally worse margin profiles than SaaS due to linearly scaling usage costs. To attain durable unit economics, we expect generalist LLM platforms to introduce high-margin advertising and commerce capabilities, thereby monetizing ad-supported, non-paying users.

The largest platforms will likely build proprietary ad infrastructure in-house to maximize margins and safeguard user data, creating new-age walled gardens (companies like OpenAI, Perplexity, Anthropic), while existing ad ecosystems (like Google and Meta) expand. Early precedents are emerging at scaled vertical AI platforms, such as OpenEvidence’s proprietary ad network for pharmaceutical brands to advertise to medical professionals.

We also believe independent, turnkey ad infrastructure for the longer tail of apps will be valuable, analogous to The Trade Desk and Taboola. Smaller, specialized apps will especially benefit from ad economics, as they often have smaller paid subscriber bases and lack economies of scale or deep pockets of the AI whales. In the future, brands can access hyper-specific ICPs at scale via neo-networks that aggregate attention across the long tail of AI platforms.

Early movers in this category include Koah Labs, Kontext, and NexAd. Initial evidence indicates a positive flywheel activating. Kontext’s real-time ad units yield 3-5% CTRs and a 2-4x lift in CPA for advertisers.5 Koah Labs demonstrates how ads alone can create sustainable economics for customers like Heal, who otherwise operate without paywalls, enabling unpaid users to access high-quality parenting support. Heal also reported that Koah’s real-time ad units did not disrupt user retention, demonstrating early alignment between economics and UX.

We believe that AI-native surface areas will extend far beyond advertising infrastructure at LLMs in the months and years ahead. AppLovin’s evolution offers a possible parallel: it shifted from owning mobile apps to owning advertising infrastructure, monetized via others’ apps (culminating in the July 2025 divestment of their mobile games business).

Today, we cannot even imagine what the long tail of AI-era ads might hold. We’re intrigued by one potential vector: massively multiplayer UGC entertainment platforms (analogous to Roblox, UEFN, Web 2.0 modding communities). Real-time ad infrastructure embedded within these UGC experiences could produce robust ad ecosystems with attractive creator economics.

Though we’re excitedly hypothesizing about the future, most of these net-new surfaces haven’t been discovered yet, and the monetization infrastructure is still a work in progress.

Extending the AI Ads Paradigm to the Open Web

As we discussed at the top, much of the critical open web will continue to thrive in this new paradigm. As with innovators developing new ad networks for AI apps, we believe there’s a tangible opportunity in creating analogous rails for serving generative ads on the open web. We’re already seeing promising players like OpenAds, Linotype, and ZeroClick building these solutions. This is initially taking the form of integrated chat assistants on websites that can access/serve context retrieved from a site’s archive better than traditional search engines, enhanced by a contextual ad layer. Early signs of success are emerging with OpenAds claiming 56% higher CTRs on generative ads than traditional context matching in performance marketing.

Conclusion

The internet is reorganizing around AI, compressing the open web, and concentrating attention around a smaller set of high-signal surfaces. Advertising is just the first of many systems that are destined to change. Ad creative, targeting, and delivery are collapsing into a single real-time loop, and a wide variety of fast-moving startups are being purpose-built for this shift.

We focused this post on the human-facing layer of internet monetization because it’s where founders are shipping today and where customers are scaling spend fastest. But a second layer is emerging beneath: a machine-readable internet where agents will transact on our behalf. Its economics won’t look like the ad-dominated Web 1.0 or Web 2.0, and its infrastructure is still materializing. In our next post, we’ll explore the emerging agent-to-agent layer, and why it may represent the largest greenfield opportunity yet.

–

Our current frameworks reflect patterns we’re seeing emerge in real time, not a settled map. If you’re building new monetization rails or creative tooling for the agentic internet – or exploring ideas that don’t fit cleanly into these categories – we’d love to hear from you. Reach us at dlay@nea.com, mmurray@nea.com, agrabelle@nea.com, rpsik@nea.com

Sources

InternetLiveStats (2025), SimilarWeb/42Matters (historical app count data accessed via Wayback Machine as of 12/15/25), Stripe (2023)

InternetLiveStats (2025), SimilarWeb/42Matters (historical app count data accessed via Wayback Machine as of 12/15/25), Stripe (2023)

InternetLiveStats (2025), SimilarWeb/42Matters (historical app count data accessed via Wayback Machine as of 12/15/25), Stripe (2023)

The Information (December 2025), Deutsche Bank Research Institute (December 2025)

Kontext website: https://www.kontext.so/advertisers

Disclaimer

The information provided in this blog post is for educational and informational purposes only and is not intended to be investment advice, or recommendation, or as an offer to sell or a solicitation of an offer to buy an interest in any fund or investment vehicle managed by NEA or any other NEA entity. New Enterprise Associates (NEA) is a registered investment adviser with the Securities and Exchange Commission (SEC). However, nothing in this post should be interpreted to suggest that the SEC has endorsed or approved the contents of this post. NEA has no obligation to update, modify, or amend the contents of this post nor to notify readers in the event that any information, opinion, forecast or estimate changes or subsequently becomes inaccurate or outdated. In addition, certain information contained herein has been obtained from third-party sources and has not been independently verified by NEA. Any statements made by founders, investors, portfolio companies, or others in the post or on other third-party websites referencing this post are their own, and are not intended to be an endorsement of the investment advisory services offered by NEA.

NEA makes no assurance that investment results obtained historically can be obtained in the future, or that any investments managed by NEA will be profitable. To the extent the content in this post discusses hypotheticals, projections, or forecasts to illustrate a view, such views may not have been verified or adopted by NEA, nor has NEA tested the validity of the assumptions that underlie such opinions. Readers of the information contained herein should consult their own legal, tax, and financial advisers because the contents are not intended by NEA to be used as part of the investment decision making process related to any investment managed by NEA