Blog

by Ann Bordetsky, Danielle Lay and Hunter WorlandJul 05, 2023

We are evolutionarily programmed to be social. Back when our ancestors had daily confrontations with existential threats, those who operated in groups were more likely to survive.

While the world has changed dramatically since then, our biological need to be connected to one another has not. The speed with which consumers have rushed back to travel, live events, in-office work and brick & mortar retail post-pandemic serves as a good reminder that we are wired to gather and be together.

For decades now, social platforms have used technology to enhance our ability to connect and communicate: Distance is no longer an inhibitor to interpersonal connection, nor is whether or not you have ever met in person. Social platforms have given us the ability to create ever-expanding social webs that span friendships, interest groups, geographies, fan communities, family, professional peers, etc. As a species, we’ve never been more connected.

Yet the same platforms have also brought out notable negative social effects – feelings of anxiety and isolation among teens and adults, the proliferation of hate speech. Incumbent social platforms that once felt magical, are now challenged by lack of user trust and the growing sense that these digital spaces are too noisy, polluted and commercial.

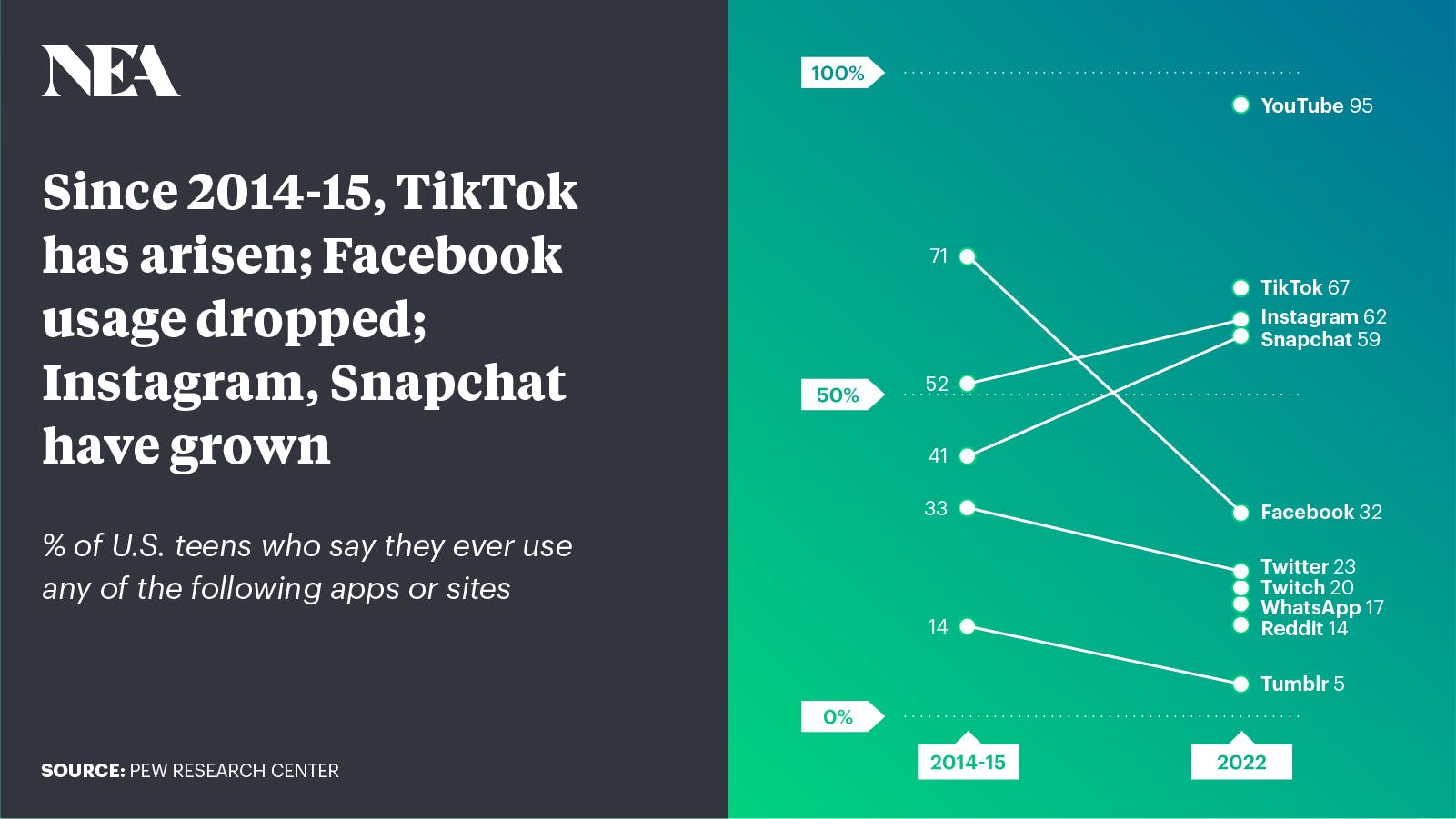

Historically, powerful network effects with incumbents have made it hard for new social platforms to reach escape velocity. Today, usage and trust of several of the largest social platforms have dropped precipitously (see image below). So, what comes next? Where are the opportunities for new players to win? What will it take to not only attract, but keep, the attention of a big user base?

Consumer tastes and behaviors are changing and there’s an opportunity for new social platforms to address those updated needs. At NEA, we are seeking to double down on the social space. Here are our eight hypotheses on the future of consumer social:

This phenomenon has been well documented but it’s impossible not to mention. Facebook used to represent a single source hub for all things social. Groups, events, messaging, photo sharing, dating, gaming, etc. As of 2022, only 32% of U.S. teens (those aged 13 to 17) report using Facebook. The equivalent measurement was 71% in 2014.

Based on original graphic by Pew Research Center

And it’s not just Facebook. We believe the largest social platform incumbents are weaker than they have ever been. The last generation of social platforms (Facebook, Twitter, Snap, Instagram) are facing a perfect storm: declining user trust, regulatory scrutiny, social / political controversy and slowing growth. Consumers are eager to find more authenticity, safety and relevance in their digital experiences. This may be a time when the whole consumer social landscape is rewritten, and many of those core critical use cases are up for grabs.

The holy grail of social was once to build new and novel features for hundreds of millions of mainstream users. Facebook, Snap, Instagram and Twitter, all were massively successful across multiple demographic cross sections (age, interest, geography, gender, psychographic, etc.). Yes, Snap found huge resonance with high school students initially, and yes, Facebook’s roots started on college campuses. Instagram was also famously a photo sharing app for photography enthusiasts. But their features delivered generic utility to different demographics, not just those on campuses or in high school.

Nowadays, features can be replicated by the big players in weeks or even days: A few months into BeReal’s meteoric rise, Instagram and Snap both launched simultaneous front- / back-facing camera stories. TikTok launched “TikTok Now” at the end of last summer. After the summer of Clubhouse in 2020, both Twitter and Spotify launched audio spaces on their platforms. The social viral incumbents aren’t like the geriatric incumbents of other industries. Here, they can wield their tremendous engineering resources, capital, and distribution to squash competition and scatter attention.

"The founder's maniacal focus on its gamer customer was evident in every product and design decision."

Discord on the other hand was built “to give people a better way to hang out before, during, and after playing video games.” The founder’s maniacal focus on its gamer customer was evident in every product and design decision. Gameplay streaming, in-game overlay, mobile screen sharing, investments in Rich Presence —, the list of gaming centric features goes on. While Discord began to publicly pivot its positioning through the pandemic to go beyond gaming communities, the distinctive utility it delivered meant that it was virtually impossible for the other social incumbents to win over the gamer customer base. A customer base that, notably, was both large and growing quickly.

Our takeaway is that one way to deliver distinct value, and to circumvent direct competition with one of the big players, is to go vertical. Delivering unique utility to a specific user base has worked in the past. Fizz, for example, provides distinct utility to college students by creating campus- specific communities that can only be joined with a verified student address. We believe no other scaled social platform can deliver that concentration of campus specific content to users.

Of the many social products that are built, few reach escape velocity. Fewer still reach escape velocity and endure. Escape velocity can happen for a whole number of reasons and can be very difficult to predict. Endurance requires giving the consumer something they need (information, love, recognition, connection, personalized content, etc.) in a deeper or more relevant way than they can get elsewhere on their phone in that moment (i.e., offers utility in a way no other app on their device can provide).

Reddit provides immediate access to the heart of any community, and the most salient topic of conversation for it at that moment in time. r/Minecraft has 7.2M subscribers and has existed for 13 years; on one day in February of 2023, 15K people upvoted a post joking about a piece of cooked cod that was categorized as “equipment” in Minecraft. Almost a thousand people commented. Repeated moments of connection through highly specific and highly relevant humor has created endurance for Reddit.

Today, TikTok is central to the proliferation of ideas and culture. The Wednesday dance, smash or pass, the clean girl make-up look, Emily Mariko’s salmon rice. A negroni, sbagliato, with prosecco in it. Products, aesthetics, tools, ideas are using TikTok as a megaphone for relevance. Those that garner genuine consumer interest hit on TikTok before they hit in the real world. Social apps are no exception. TikTok videos about new dating apps, travel planning apps, studying apps, and even BeReal have gone viral organically, turning into an important driver of customer acquisition. TikTok is both the most formidable and consistent contender for consumers’ attention, and a near necessary channel for new social players to succeed.

Generative AI has taken the technology world by storm. Content creation has become sequentially cheaper over the last century, making way for more and more distributed sources of content. Networks on cable television → professional vloggers on Youtube → everyone on TikTok and Instagram. Each progressive media era had orders of magnitude more content, meaning the overlap in content that two strangers consumed shrunk as more niches thrived.

AI generated content represents the next step in this inevitable sequence. AI generated content, eventually, will likely be cheaper than all other media forms to create, personalize and generate on-demand – content made just for you in real time. Generative AI will give us the tools to imagine and co-create shared visual experiences, communicate via conversational agents trained on our personal data and represent ourselves through synthetic voice and video, to start. What we do with that is yet to unfold but it will surely lead to another step function change in our social norms and interactions online.

The blue check mark is a fascinating social phenomenon. For more than a decade, blue check marks and verified badges have been a signal of influence and legitimacy on social platforms. With the proliferation of generative AI, blue check marks may begin to serve a much more functional purpose. Generative AI creates a whole new dimension for safety in social – did that politician really say that? Misinformation exists today en masse, but generative AI has made it both very cheap and very convincing to make fake content. Platforms are going to have to find a way to verify a lot more information. But where there is challenge, there is opportunity.

Social commerce sounds like a $100B category in the making, and for years investors and founders have been hungry to found or invest in a company that enables consumers purchase socially. It seems as though every iteration of social commerce has been tried in the U.S. on some scale, but no platform has yet reached the heights of our expectations.

Our hypothesis here is that the social platforms that had the attention of the consumer were jumping too quickly from media to conversion. Instagram is a place for content consumption. Inspiration, yes. But also friend content, family content, among other things. Purchasing is a different mindspace that takes consumers out of their core experience. On the other hand, new social commerce companies that did not yet have consumers’ attention were not providing sufficient utility to transition user behavior away from directly searching for something to purchase on Amazon or through Google.

Search may be the bridge. Websites are to Google as videos are to TikTok. Since the great battle of Search decades ago, little drama has come to the Search ecosystem with Google as the obvious reigning king. In 2023, the tectonic plates of search started to shift with Bing, Chat GPT and new search engines like Perplexity AI, among others. TikTok is another quiet contender in Search that is not yet mentioned in the same breath as Bing and Google. A few months ago, TikTok launched a suggested search for viral videos. It’s a quiet recognition from the social giant that consumers have* been using TikTok as a search platform. While the search use cases are likely more grounded in inspiration (think travel-destination Tok) and information (think award-show Tok) today, that demand is already converting to transactions on TikTok, as it has historically on Google. The hashtag "TikTokMadeMeBuyIt" has 60.2B views on TikTok.

The fundamentals of social networks. Community begets community, network effects are necessary. We’re not going to change the lizard brain. Successful social products are likely to offer some combination of:

"The social landscape will more closely reflect how communities develop in the real world."

Psychological reward

Network effects and/or new social graphs

Psychological safety and moderation

New formats and form factors for self-expression

Virality and cultural relevance (Zeitgeist value)

The future of social will stand on the shoulders of giants — Facebook, Twitter, Snap, Instagram —- but will look different than the past. We believe the social landscape will more closely reflect how communities develop in the real world. We may move away from the one-platform-for-all paradigm into a constellation of more private, authentic, interest or use case specific social channels and products.

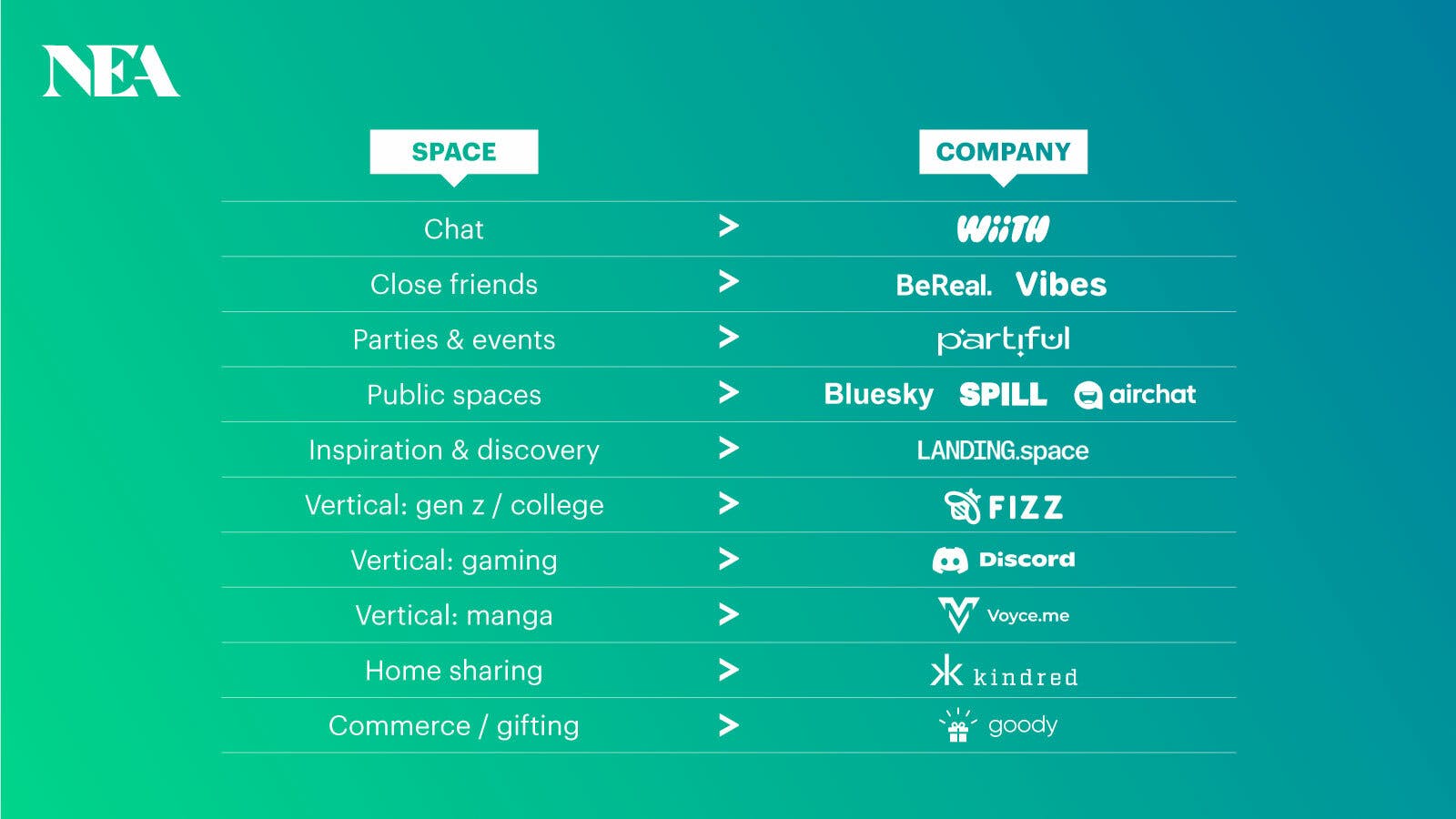

The following are a few of companies that we believe represent the next era of consumer social that we're excited to watch.

Companies: Wiith, BeReal, Vibes, Partiful, Bluesky, Spill, Airchat, Landing.space, Fizz, Discord, VoyceMe, Kindred, Goody

Consumer social is hard to predict and almost always surprises us. There’s never been a better time to launch new consumer social products. If you’re building in this space, we’d love to hear from you. Contact us at dlay@nea.com, abordetsky@nea.com, hworland@nea.com.

The information provided in this blog post is for educational and informational purposes only and is not intended to be investment advice, or recommendation, or as an offer to sell or a solicitation of an offer to buy an interest in any fund or investment vehicle managed by NEA or any other NEA entity. New Enterprise Associates (NEA) is a registered investment adviser with the Securities and Exchange Commission (SEC). However, nothing in this post should be interpreted to suggest that the SEC has endorsed or approved the contents of this post. NEA has no obligation to update, modify, or amend the contents of this post nor to notify readers in the event that any information, opinion, forecast or estimate changes or subsequently becomes inaccurate or outdated. In addition, certain information contained herein has been obtained from third-party sources and has not been independently verified by NEA. The companies featured in this post are for illustrative purposes only, have been selected in order to provide an example of the types of investments made by NEA that fit the theme of this post and are not representative of all NEA portfolio companies. The company founders or executives or any other individuals featured or quoted in this post are not compensated, directly or indirectly, by NEA but may be founders or executives of portfolio companies NEA has invested in through funds managed by NEA and its affiliates. Any statements made by founders, investors, portfolio companies, or others in the post or on other third-party websites referencing this post are their own, and are not intended to be an endorsement of the investment advisory services offered by NEA.

NEA makes no assurance that investment results obtained historically can be obtained in the future, or that any investments managed by NEA will be profitable. To the extent the content in this post discusses hypotheticals, projections, or forecasts to illustrate a view, such views may not have been verified or adopted by NEA, nor has NEA tested the validity of the assumptions that underlie such opinions. Readers of the information contained herein should consult their own legal, tax, and financial advisers because the contents are not intended by NEA to be used as part of the investment decision making process related to any investment managed by NEA.